5 Myths Around Debt

There are many common misconceptions about debt. So many people feel the limitations imposed by debt each and every day. Let me show you just five of these myths and give you some fool-proof tools you can really use!

There are many common misconceptions about debt. So many people feel the limitations imposed by debt each and every day. Let me show you just five of these myths and give you some fool-proof tools you can really use!

5 Myths Around Debt & Fool-Proof Tools to Bust Through Limitations

Myth 1: I’ll never get free from debt

People who have debt often feel that they can never change it; they can never get free. This is simply not true! Everyone I know that’s been in debt has created more money for themselves. I myself have done it. Years ago, I was $187,000 in debt when I met Gary Douglas, the founder of Access Consciousness®. I started to use the tools of Access and to change my points of view around money. As I changed my relationship with money, it became possible to make more money and educate myself about money. Of course, the biggest thing is choice. I actually chose to commit to a life where I had money.

Myth-buster: It’s literally possible to change anything!

Myth 2: I tried before and failed, it’s simply too hard

First, stop making yourself wrong. Judgment does not create anything. Second, realize that people often perpetuate the same financial reality as their family and never question it. If your parents ignored their bills or avoided them, it doesn’t mean you have to do the same. You can always make a different choice. What if you could get out of debt joyfully? Every time you think it’s too hard, say the Access mantra: All of life comes to me with ease and joy and glory®.

Myth-buster: Ask yourself, what is my point of view about money? What is my point of view about me with regard to money? Then be willing to ask for more in your life. Ask and you shall receive.

Myth 3: I just can’t figure out where all my money goes

I find it totally amazing that many people have no idea exactly how much money they’re making or what their expenses are. I suggest you sit down with a pen and paper and write down your outgoings: your expenses, rent, food, utility bills etc. Not just the bare bones, but what you really spend in your life. Or, you could use a spreadsheet to record everything; that’s what I do. It’s just information, so don’t make it significant or judge yourself.

Figuring out where all your money goes will give you awareness of your entire financial situation. A lot of people avoid this knowledge hoping things will simply get better, or someone will help them out at the last minute. If you truly desire to get out of debt, you have to get clear on your finances. No one else is going to do it for you.

Myth-buster: Make a demand that from today – not mañana – you’ll get clear on your expenses. Once you’re aware of something then you can change it.

Myth 4: I’ll never have enough money

One of the tools that really turned my finances around was setting aside 10 percent of every dollar that I earned and not spending it. I have a friend who couldn’t trust himself not to spend his 10 percent account on bills. So he tricked himself into having money – by using that money to buy silver! At first he’d buy a silver spoon for $40 or perhaps a kilo of silver. After a while, they added up and the energy of wealth started to creep into his life. You can exchange silver for money, but it takes time and is inconvenient. He always found a way to pay the bill without liquidating his silver.

Myth buster: Don’t use your 10 percent to pay your bills, look at what other income streams you could use to create the money. Your 10 percent is not for a rainy day. Invest it by buying gold and silver or things that you know won’t lose money. Or, just set it aside in an account and watch it grow.

Myth 5: I’ve got to settle for what I’m given

When I first started going to Access seminars around the world, I did it on the cheap. I traveled economy class and stayed in friends’ houses. This was fine, except I like to get up early morning and start work, without tiptoeing around people.

At some point, sharing a bathroom with eight people no longer worked for me. So, I made a demand of myself that no matter what it took, and no matter what it looked like, I’d make enough money to stay in a hotel room when I went for seminars.

After a while, I got to a point where traveling long haul in economy-class didn’t work for me. Again, I made a demand of myself to travel business class. What I did was work out how to increase my frequent-flyer points, so I could put in for an upgrade. The energy of my life gradually became more what I was demanding, rather than having to settle for things.

Myth-buster: What if you always demanded more for your life? Start with the baby steps. How do you get enough frequent flyer points to upgrade your flights?

Getting out of debt and having money doesn’t mean all the problems in your life go away. Your life gets bigger and, if you’re willing to allow that, different doors can open. So many people out there think money is the answer, but that’s not it at all. Money is just fuel. It gets you where you’re going. The fewer points of view you have about money, the easier it is.

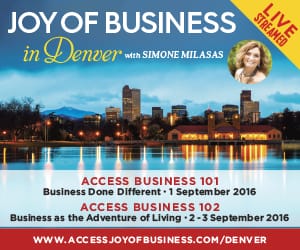

Simone Milasas is a dynamic leader who travels the globe demonstrating how to do business from a place of joy. She has been at the forefront of cutting edge business creation and development for over two decades. She sees the joy of possibility and future and knows that there is the prospect of possibility in every choice. Simone is the author of the internationally acclaimed book, "Joy of Business" (currently available in 11 languages) and released her second book, "Getting Out of Debt Joyfully."